During the pandemic, “buy now, pay later” apps (BNPL) skyrocketed in popularity. In fact, as many as 60% have used such a service, with some consumers using ‘buy now, pay later' options more than once a week.

So what is this new trend?

As its name implies, BNPL apps enable consumers to purchase a product and then pay for it in installments (usually across a few weeks or months). In other words, consumers take on short-term debt to satisfy their immediate buying wishes/needs.

This payment model has been popular with furniture stores and the automotive industry for some time. This is an excellent example of where purchases needed in the day-to-day world are too high a financial burden to pay outright. However, with BNPL options, split payments are becoming increasingly mainstream.

Affirm, and Sezzle are two such BNPL apps enabling consumers to get their hands on the things they need. So, in this Affirm vs Sezzle review, we're putting each app under the microscope to help you better understand which (if either) is the better choice for your business.

Let's get straight down to it!

What is Sezzle?

Sezzle is a fintech company headquartered in Minneapolis that's been around since 2016. It launched with a mission to empower change-makers. Their e-commerce vendors, therefore, include black-owned businesses, ethical and sustainable brands, and small businesses. They even support artisanal merchandise to help assist smaller creators.

But unfortunately, it doesn’t seem to match Affirm’s popularity. In fact, one study suggests that 28% of BNPL users opt for Affirm compared to just 8% for Sezzle. Despite this, it's worth noting that Sezzle offers very similar services, works alongside many popular online vendors, and offers some fantastic deals.

What is Affirm.com?

Affirm has been around a little longer. Since its founding in 2012, they have facilitated over 17 million purchases and aims to provide an honest financial service that improves lives by giving more economic power to the individual. Its main philosophy is to present shoppers with transparent payment plans and interest so that conscientious buyers will never have to endure nasty surprise costs.

Sezzle vs Affirm: The Shopping Experience

Now that we've covered the basics let's look at Sezzle and Affirm's shopping experience. First up, Affirm:

Shopping with Affirm

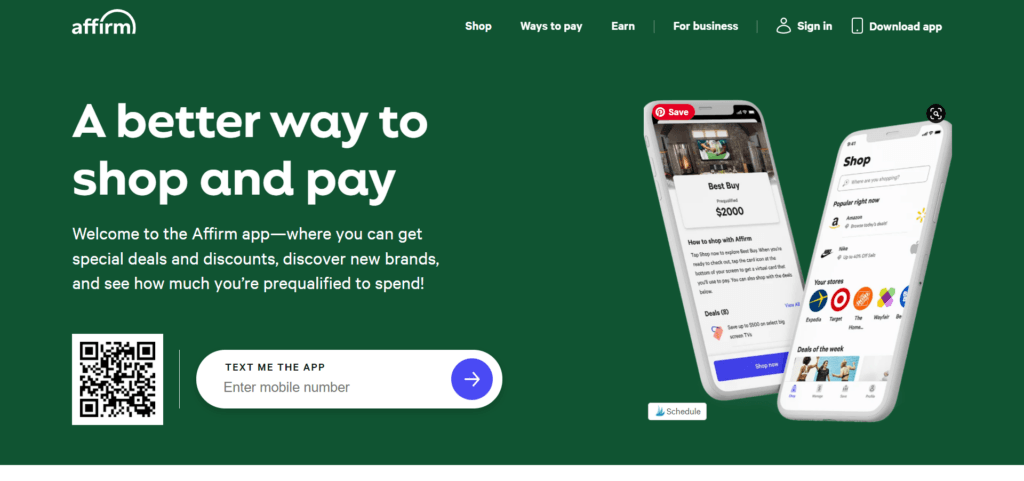

To sign up, just download the app from the Google or Apple store and enter your details, including your phone number, email, and social security number. Then you can start shopping. Users will find Affirm listed as a payment option within the checkout of eligible vendors, such as Adidas, Target, Samsung, Walmart, to name a few…

Alternatively, you can apply for a virtual card. For this, you’ll need to fulfill Affirm’s eligibility requirements. This eligibility check won’t impact your credit score. An Affirm virtual card is similar to a credit card, where you receive a loan directly from Affirm to pay for your purchase. This comes in handy if you wish to ‘buy now and pay later’ with a company that doesn’t partner with Affirm. In practice, this means you can pay using your Affirm virtual card at any checkout. To be eligible for this card, you need to live in the US, be over 18 years of age, and have a social security number. You also need to create an Affirm account.

On Affirm’s website, you can browse shopping categories to find brands that accept Affirm payments.

Categories include:

- Accessories

- Apparel

- Auto

- Beauty and health

- Electronics

- Fitness and gear

- Home and furniture

- Shoes

- Travel

- Wedding

- Luxury

Sezzle

Sezzle has a similar list on their website when it comes to shopping categories, though their offering is slightly broader.

For example, they include:

- Electronics

- Pets

- Arts and crafts

- Toys and games

- Travel and entertainment

- Food and beverage

- Wholesale

- Artist merch

- Baby and kids

- Sports and outdoors

- Men and women’s fashion

…The list goes on.

On Sezzle’s website, you can also conveniently shop for deals across their partnerships, filtering these by country (US or Canada) and category. Sezzle is available in the UK, Hong Kong, India, Germany, and several other countries worldwide. Deals include free shipping, cashback, or discounts. Sezzle partners with around 44,000 brands, so you won’t be lacking for choice!

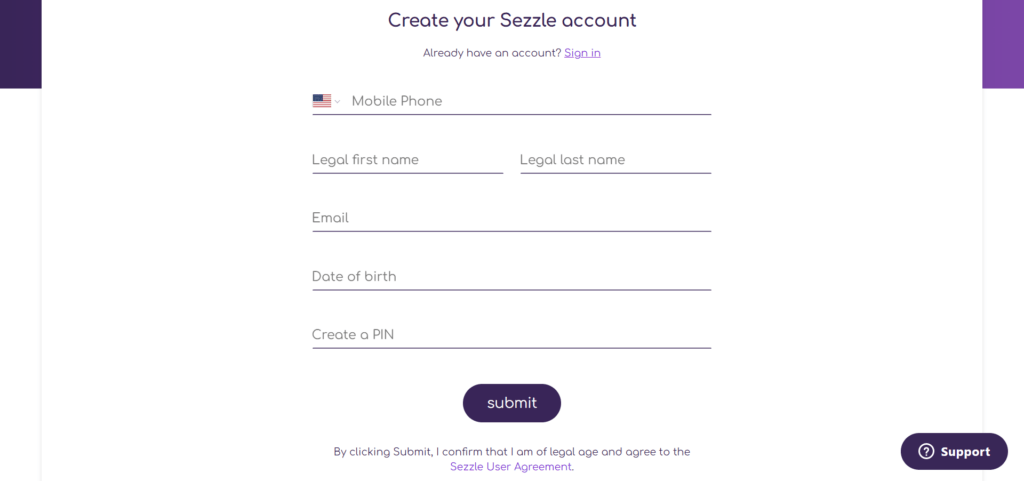

In terms of the shopping process, Sezzle works much the same as Affirm. You can opt to use Sezzle as your preferred online payment option at any eligible checkout.

You can also use a Sezzle virtual payment card. The Sezzle virtual card works much the same as a credit card. Here, Sezzle takes on the amount owed as a loan. You pay a quarter of the order price up-front, and Sezzle takes on the rest of the amount owed for you to pay later. Unlike Affirm, with Sezzle, you must pay 25% of your purchase upfront. The rest of the payment is taken over six weeks with three more payments.

Sezzle vs Affirm: How Payments Work

Next up, let’s examine the nitty-gritty of how payments work with both Affirm and Sezzle. So, again, first up, Affirm:

Affirm

Shopping with BNPL apps is simple, and Affirm proves this concept right. With the app, you can shop nearly anywhere (online and in-store) with merchants that accept Google Pay and Apple Pay, with a few payment options to choose from:

The first is Affirm Pay in 4. Here, you can opt to make four interest-free payments every two weeks. There are no fees involved, and the loan doesn’t impact your credit score. In addition, you can easily set up automatic payments (called autopay). With this option, your installment payments are automatically debited from your account at the due date.

There’s also the ‘Monthly Payments’ option. This works much the same, only instead of paying in four installments, you pay a monthly fee until a big-ticket item is paid off. You can choose how much you repay a month. However, this model does incur interest. Interest is added upfront, and, as such, it’s part and parcel of your payments. Your interest rate may sit between 10-30% APR based on your credit rating and is subject to an eligibility check.

It’s worth mentioning, while Affirm only runs a soft credit check (one that won’t affect your credit score), they state they will report to the credit bureau if you have more than 0% interest on your loan. Aside from this interest, which you must review and agree to when you purchase, there are no account fees, hidden fees, or prepayment fees. Not to mention, no fees for missing a payment!

The last payment option with Affirm is their credit card. However, this is still in development, and there’s a waiting list to signup. With the Affirm credit card, you can use it as a regular card but with installment plans so that you can split any purchase into monthly payments or four installments.

Sezzle

At first glance, Sezzle offers a very similar payment scheme.

Their primary payment plan enables customers to make four interest-free payments over six weeks. You’ll pay the first installment on the day of the purchase and the other three same-sized payments every two weeks after that. You can also reschedule a payment on an order once for free. The second or third time incurs a fee (usually $5) added to your next payment.

However, no fees are involved when you pay on time, and your credit score isn't impacted if you make your payments on time.

When you initially create a Sezzle account, they run a soft credit check, so rest assured, your credit score isn’t affected. However, they’ll report any failed payments to the credit bureau every month. If you miss a payment, there’s also a late fee, which is usually $10 but can reach up to $50. However, this is dependent on individual state regulations.

Sezzle vs Affirm: Spending Limits

Both Sezzle and Affirm want to encourage responsible spending and impose spending limits on their customers in light of this. So let’s take a look…

Sezzle

Sezzle uses an automated system that considers various factors, such as how long you’ve been a Sezzle shopper and your soft credit check. However, finding your spending limits with Sezzle is a bit tricky.

Currently, only US shoppers that have signed up to Sezzle UP can check their spending limits and request a one-time limit increase. Sezzle UP is a free service specifically designed for those looking to improve their credit scores. When you use Sezzle UP and pay on time, they increase your spend limit accordingly to reflect the growth of your credit score. In other words, you can see how each purchase affects your score before it’s sent to the credit bureau and manage your credit accordingly.

Affirm

Affirm similarly takes your financial conditions into account before approving a loan. Eligibility factors include your credit score, payment history with Affirm, how long you’ve had an account, and the interest rate the merchant in question is offering. Loan eligibility criteria are discussed with each merchant and can differ accordingly. That said, at the time of writing, the maximum purchase amount is $17,500, but this may be less depending on the customer.

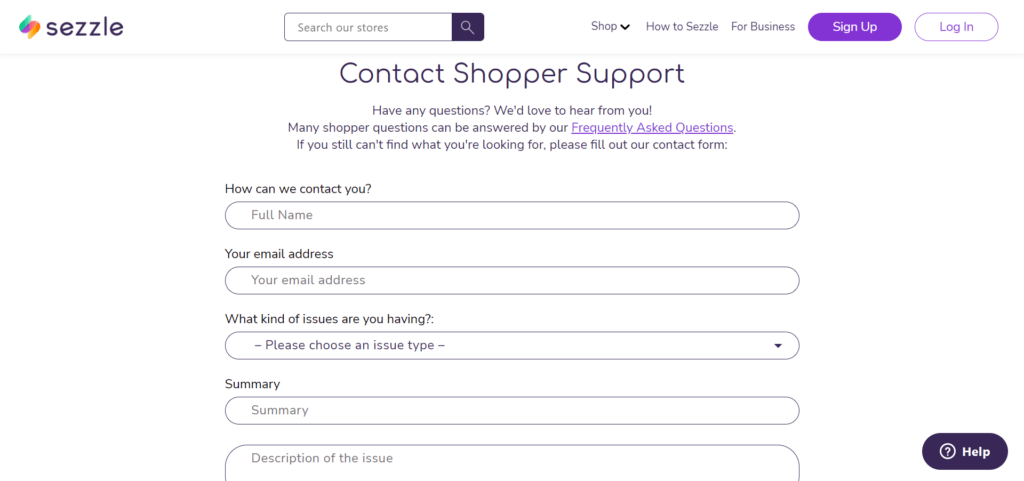

Sezzle vs Affirm: Customer Service

Sezzle has an extensive online knowledge base that includes a shopper's FAQs page. Here, you’ll find information on making payments, products, and services and ways to contact Sezzle if anything goes wrong.

However, suppose you want to speak to a customer service agent. In that case, you can contact Sezzle via email or call them between 8 am to 5 pm CTM.

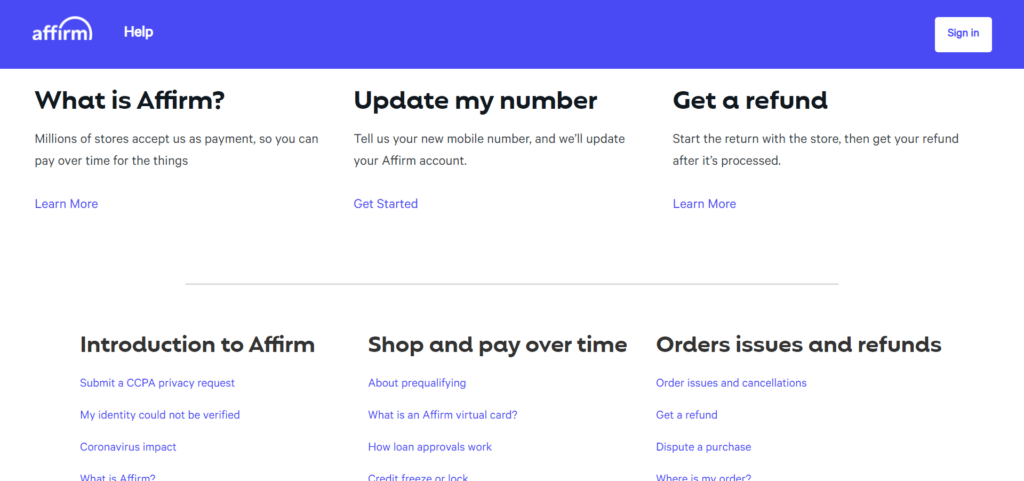

Similarly, Affirm has an online help center where you can find answers to commonly asked questions. Alternatively, you can reach Affirm via email or phone, between 8 am and 8 pm Monday to Sunday, EST.

Further reading 📚

Sezzle vs Affirm: Pros and Cons

For a more direct comparison of the two services, let’s quickly review their most essential pros and cons.

Sezzle Pros

Pros 👍

You can easily view deals on their website

There are over 44,000 vendors to choose from

You get one free payment reschedule

Sezzle offers a broader range of shopping categories than Affirm

Sezzle doesn’t charge interest

You can spread the cost of purchases over four installments in six weeks

Sezzle integrates with Shopify

Cons 👎

You incur a late fee if you miss a payment (which, to be fair, we think is pretty reasonable)

Sezzle’s spending limits are unclear.

If you want to reschedule a payment more than once, you’re charged a fee.

There isn’t much flexibility on payment schedules.

You can’t pay off your balance early.

Sezzle doesn’t automatically approve 100% of orders. It may decline if you have unpaid orders or failed payments.

Affirm Pros and Cons

Pros 👍

Users aren’t charged account fees, annual fees, or even late fees. You're notified if you miss a payment, but you won’t be fined.

For high-ticket items, you can set up monthly installments across three, six, or twelve months.

Affirm allows you to pay off your remaining balance when your next payment date comes along.

You can sign up for an Affirm debit card to easily arrange payment in installments.

Some retailers offer rates with 0% interest.

Affirm integrates with Shopify

Cons 👎

Compared to Sezzle, there aren’t as many vendors; currently, 2,569 companies use Affirm, compared to Sezzle’s 40,000 partners.

Affirm charges interest when you make payments, ranging from 0% APR to 10-30% APR. This depends on the vendor and your credit score, so it’s difficult to predict when you’ll be eligible for a loan and how much it will cost.

Affirm’s signup process is a little lengthier as it also requires your social security number to authenticate your identity.

Late payments don't incur charges but may impact your credit score.

Due to the pre-qualification process on each transaction, not all of your purchases might be approved.

Sezzle vs Affirm: Our Final Thoughts

So, there you have it. We’ve reached the end of our Sezzle vs Affirm review.

It’s plain to see why Affirm is the more popular of the two. The app works with a large variety of vendors that charge 0% APR and doesn’t charge late fees, often making this payment option the more forgiving of the two.

Affirm is also the more flexible option, thanks to its different payment plans. As discussed, Affirm lets you pay over monthly installments, whereas Sezzle only allows you six weeks. As such, Affirm is better suited to larger purchases that need paying off over a longer period.

Sezzle, on the other hand, works well for smaller purchases and is well suited to those that can afford a 25% down payment on such investments. In addition, it charges no interest, so long as you make your repayments on time. That said, paying late or having to reschedule repayments will incur extra fees. So, when it comes to Sezzle, you’ll need to be more careful with your finances.

We consider Affirm the slightly safer option as it has a few more fail-saves in place. First, you’ll always know how much you’re spending ahead of time. While Sezzle doesn’t charge interest, you can incur a fee if you fail to pay on time. Finally, Affirm’s pre-approval process for each transaction ensures that if your credit score worsens, you can't spend more than is reasonably expected for you to pay back.

What do you think? Sezzle vs Affirm, which would be your go-to app for “Buy now, pay later?” Or, are you considering another payment platform like Klarna or Afterpay. Either way, let us know in the comments box below!

Comments 0 Responses