One downside of going with a third-party payment gateway is sometimes you end up being redirected to that third-party's website.

That's not the case with Shopify and Bigcommerce, but sometimes people want to insert PayPal or certain legacy payment systems that push customers away from your site.

SecurionPay, on the other hand, has no redirections, and it does more than just collecting payments from your customers. I like this news, since it gives companies an incentive (other than transaction fees) to go with a payment gateway.

SecurionPay focuses on increasing conversions for merchants, and it works great for European markets, along with other countries (since it supports up to 160 currencies and 23 languages).

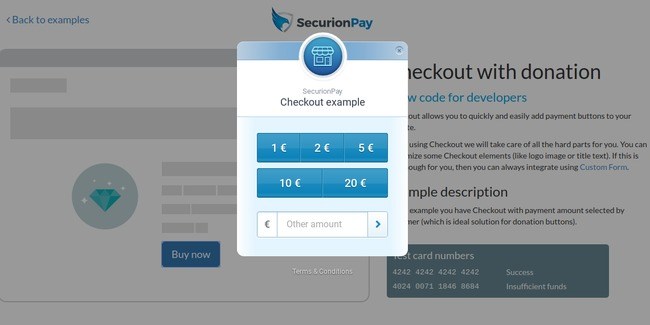

The easy integration comes in handy, and pretty much all payment scenarios are supported, like with donations, language selections, custom forms and more.

I also enjoy the fact that SecurionPay has been known to accept high-risk merchants, so if you're selling tickets for events, this might be a good choice for you.

Overall, the SecurionPay payment system seems promising, so keep reading to learn more about what I learned with my review.

What's the Deal with SecurionPay?

Here are some of the features I like the most:

A Highly Customizable Checkout Popup

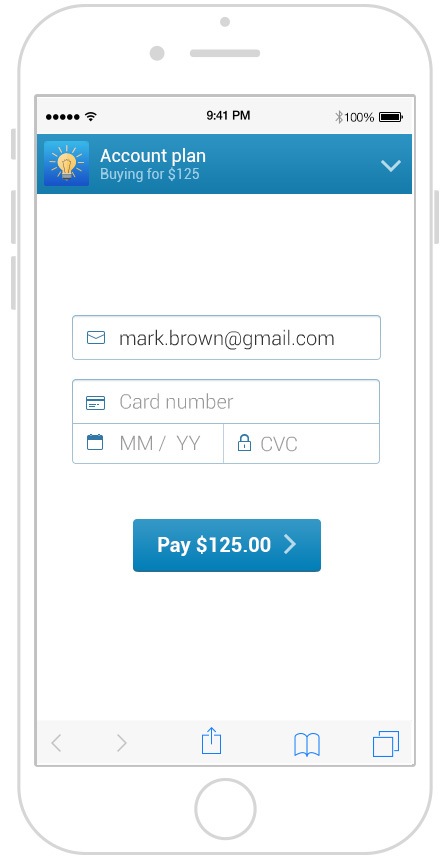

The checkout module looks like a popup form. Therefore, you're not being redirected, and there aren't any additional steps that your customers have to make. It's all managed on the same page. The primary reason I like the SecurionPay system so much is because of the wide variety of forms. We talked about it a bit above, but SecurionPay offers templates for accepting donations and a wide variety of customer information.

Custom Forms for Embedding Payments into Your Site

The custom forms integrate with your website using embedded code. It lets you adjust the fields and choose whether or not you would like a one-step checkout. For example, some companies might already have a more complicated checkout process with upsells during some of the steps. If that's the case you can separate the forms into different pages.

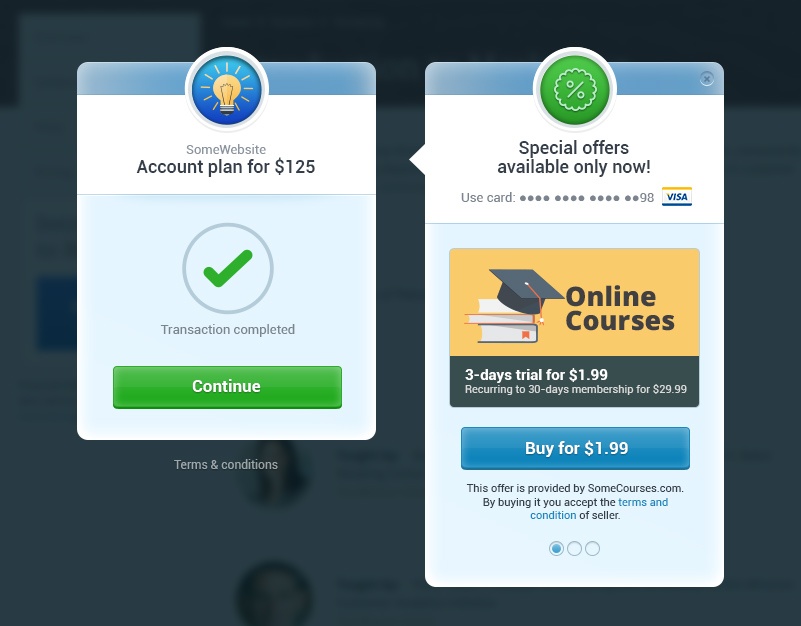

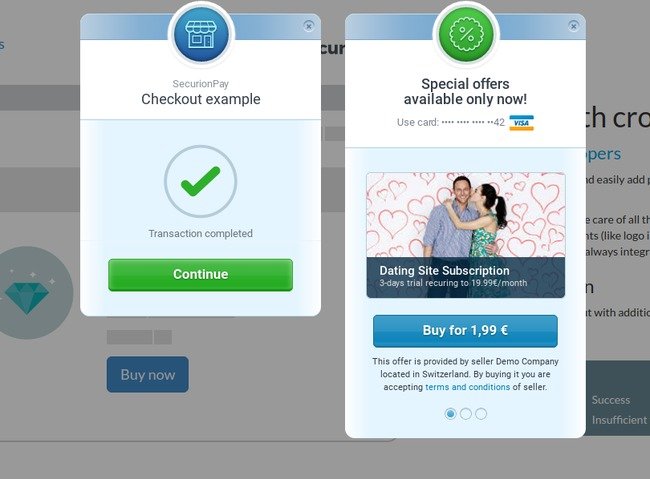

Recurring Payments, Subscriptions and Cross-sales

If you're interested in getting recurring payments from members or subscribers, it's all built into the SecurionPay platform. Feel free to configure flexible subscription periods or multiple pricing levels.

You also have the ability to offer cross-sales during your checkout, where additional products or offers are shown to the customer before or after they make the purchase.

Mobile Support

Although SecurionPay doesn't have its own mobile app, it lets you integrate with mobile apps and mobile sites. Therefore, you can keep up with the growing trend of people shopping on their mobile devices.

Impressive Integrations

A drag and drop building solution is provided for non-technical people, but the more advanced developers are going to love the API access. The options are endless when working with the API, since you can construct your own apps to integrate or figure out ways to make SecurionPay work better with your current system.

SecurionPay Pricing

This is about the most simple pricing structure you can find with a payment processor. Considering the majority of SecurionPay merchants come from Europe, the pricing is listed in Euros.

You don't have to pay a dime for anything until you make a successful transaction:

That transaction fee is 2.95% + 0.25 Euro.

Companies with higher sales are most likely going to enjoy this pricing more, but we can at least say that the SecurionPay is transparent about its pricing.

What else can you expect from the payment processor in terms of fees?

- No setup fees at all.

- No monthly fees – So if you never make a sale, you don't pay a dime to SecurionPay.

- No hidden fees or surprises.

- All chargebacks are subject to a payment of 25 Euros. You can't avoid this with any payment gateway. It's just one of those things you have to put up with. However, SecurionPay provides some fraud prevention tools to ensure that someone isn't scamming you with a chargeback.

SecurionPay Support

With all online payment methods, it's nice to know how you can complete your own research on the system and potentially contact the support team. You gain access to a blog and knowledge base when becoming a SecurionPay customer. Both of these are best for when you'd like to complete your own research.

SecurionPay also offers an FAQ and contact form. The emails are divided up into department, so you're more likely to get someone that's going to help you with your problems (sales, payment, support, etc.) The support team does have a live chat box, but I haven't found any information that suggests a phone line is available.

SecurionPay Security

You actually have the option to accept your payment with or without PCI compliance. I would obviously recommend you go the PCI compliant route, but it's interesting to see a company give the merchant an option.

Along with that, SecurionPay manages fraud prevention through something called 3D Secure, which automatically authenticates transactions with the customer's bank, decreasing the number of chargebacks in the long-run.

Finally, each transaction is scored and monitored depending on how suspicious it looks. Therefore, you can make decisions on whether to blacklist a customer or reject a payment.

Who Should Consider SecurionPay for Their Online Store?

I would start by recommending SecurionPay to merchants in Europe. The company is located there, they have their pricing setup in Euros and you can't beat the transparent rates. That said, SecurionPay does state that it accepts higher risk merchants (and hundreds of languages and currencies are supported). Therefore, you might be able to make a deal with them in an emerging market.

As for business size, you'll have to do the math to see if it makes sense for your company. I would assume that smaller companies might have trouble with the “percentage +” transaction fee, but the good news is that you don't have to pay a monthly fee, leaving you with no costs if you fail to make any sales.

If you have any questions about SecurionPay, or if you've utilized the payment gateway in the past, let us know your thoughts in the section below.

Comments 0 Responses