Finding the right bank account for your business can take time and effort. There are many options out there, including old-school high street banks and newer 100% online ones.

So, to help cut through the noise, I'm looking at two online contenders: Revolut Business and Monzo Business. Both are well-known, especially for their online banking products. But today, I'm examining their business accounts.

But if you don't have time to read my entire Revolut Business vs Monzo Business comparison, here are a few headlines about each:

- Monzo is an award-winning UK-registered bank that offers free and paid business accounts.

- Revolut has been around longer and offers seven business account types.

- Both platforms are FCA registered.

- Monzo is predominantly aimed at small businesses, whereas Revolut offers a range of accounts to suit businesses of all sizes, freelancers, and sole traders.

- Both are easy to set up and accessible via their mobile apps.

With all that said, let's dive into the crux of this Revolut Business vs Monzo Business review:

What is Revolut Business?

Revolut Business launched in 2017, just two years after founders Nik Storonsky and Vlad Yatsenko founded Revolut.

It's registered with the Financial Conduct Authority, and more than 10,000 businesses a month sign up to Revolut Business, with the platform issuing 130,000 cards monthly. It's also worth highlighting that Revolut won ‘Tech Company of the Year' at the UK Tech Awards 2020.

I like that Revolut Business fits nicely with the platform’s main focus; simplifying money management. It aims to provide businesses with one centralized place to manage all their finances, including doing business in 25+ currencies across 100+ countries.

You might qualify for a Revolut Business account if you’re a company or sole trader registered in and with a physical presence in the following countries: Aland Islands, Australia, Austria, the United Kingdom, the United States, and loads more. You can read more about Revolut Business’s eligibility requirements here.

What is Monzo Business?

According to its website, Monzo Business is aimed at small businesses that want to stay in control of their finances via the Monzo app (accessible via Google Play and the Apple App Store).

Founded in 2015, Monzo is a fully FCA-regulated UK bank with offices in London, Cardiff, and San Francisco. It launched Monzo Business in 2021, and in 2022, it won ‘Best Business Banking Provider' at the British Bank Awards. According to Monzo’s website, more than 250,000 business owners have signed up with Monzo business.

You can qualify for a business bank account if:

- You’re a sole trader

- A director of a UK-registered and UK-based Limited company.

- You’re an active Limited company registered at UK Companies House

- A tax resident in the UK.

You can check out Monzo’s full eligibility criteria here.

Revolut Business’s Features

Revolut Business has a range of accounts aimed at companies and freelancers. It splits its features into five overarching categories. Within each one, you’ll find plenty of features (what you’re entitled to vary depending on the account you plump for):

Essentials

- Cards: Metal cards, plastic company cards, and virtual cards.

- Multi-currency account: Transfer, exchange, and receive money in 25+ currencies

- Teams: Manage your team’s spending in real-time, including setting and altering spending limits and authorizations

- Transfers: Approve and track all money transfers in real time.

Accept Payments

- Accept payments: Accept and track online and in-person payments in 25+ currencies (with next-day settlement). Please note: there are no currency conversions unless you ask Revolut to do that.

- QR codes: Create QR codes to accept in-person contactless payments via your smartphone.

- Payment links: Create and share payment links (via email, invoice, and SMS).

- Payment gateways: Tailor your website’s checkout with Revolut’s widgets and plugins, including Xero, WooCommerce, Shopify, Big Commerce, and OpenCart.

- Revolut Pay: Publish single-click checkout buttons on your website with Revolut Pay.

- Revolt Reader: Take in-person payments compatible with Apple Pay, Google Pay, and all major credit and debit cards.

Tools

- Analytics: Recieve spend analytics by team, project, or your entire company

- Invoices: Create, send, and monitor invoices

- Team expenses: Authorize team members to use expense cards, set limits, and survey their spending in real-time.

- Payroll: Set up employee payroll (including automated tax calculations and customized pay schedules per employee).

- On-demand pay: Employees can track their wages per shift/week/month and pay £1.50 to withdraw a portion of their accrued earnings before payday.

Connect

- APIs: Build custom integrations (if you subscribe to a paid account).

- API payouts: Make automated payments, such as to contractors or paying out insurance claims.

- Integrations: Including Sage, Zoho Books, Xero, Shopify, Slack, and WooCommerce.

Treasury

- Currency exchange: Use the Revolut app or website to exchange 25+ currencies 24/7 at the real exchange rate with no hidden fees.

- Forward currency contracts: Protect your currency exchange rate for 12 months. This is available in USD, GBP, and EUR. Set up and manage foreign contracts online to the maximum value of £500,000.

- Crypto: Buy Bitcoin and/or Ether with no hidden fees using a Revolut Bitcoin account. But please note: this type of account is unprotected and unregulated.

Monzo Business Features

Monzo Business boasts the following features (precisely what you’ll receive will depend on which account you opt for):

- Tax Pots: Set a percentage of your income to automatically set aside for tax every time you’re paid.

- Get paid: Create and send invoices and payment links. You can accept Apple Pay, Google Pay, bank transfers, and Stripe card payments (a 1.5% + £0.20 fee per Stripe payment applies). You can also view all overdue payments at-a-glance within the Monzo app.

- Mobile and web access: Access your account via the Monzo mobile app or desktop.

- Multi-user access: Add up to two users to your account (available for Limited Companies and sole traders)

- Integrated accounting: Sync with Xero, FreeAgent, and QuickBooks. You can also export your transactions via CSV, PDF, or QIF files to forward to your accountant.

- 24/7 customer support: Access 24/7 in-app human support or call between 8 am and 5 pm (UK time). Alternatively, you can email them.

- Savings Pots: Earn up to 1.5% AER (variable) on your savings with no minimum deposit and instant access

Revolut Business Prices

Revolut offers two business account types:

- Company (aimed at more established businesses)

- Freelance (aimed at freelancers and sole traders).

Four accounts fall within the Company category:

Free

With the free plan, you’ll receive the following:

- Up to three plastic cards per person (fees may apply, but these aren’t listed)

- Up to 200 virtual company cards per team member

- Five free local payments per mo (£0.20 per transaction after that)

- A crypto exchange fee of 1.99%

- Spend in 150+ currencies.

- Hold and exchange money in 25+ currencies.

- Free transfers to other Revolut accounts

- IBANs for global transfers

- You can manage recurring transfers.

- Local accounts in GBP and EUR

- Accept domestic payments online for a 1% + £0.20 fee.

- Accept payments online for a 2.8% + £0.20 fee for international and commercial cards

- Accept payments via Revolut Pay for a 1% + £0.20 fee.

- Bank transfers for £1 or less

- Create and track invoices.

- Accept in-person payments for a 0.8% and £0.02 fee for UK consumer cards and 2.6% and £0.02 for international and commercial cards.

- Register unlimited team members and grant team member permissions (I.e., the access they have to your account – view-only, perform financial operations, limited spending, or full access).

- Manage team member expenses for £5 per month per team member.

- Access 24/7 support

- Manage payroll for £3 per month per team member on the payroll.

- App integrations, including those mentioned in the features section above. Other examples include Netsuite and FreshBooks.

- Web and mobile access to your Revolut Business account

- Payment link creation

Grow

This costs £25 per month (or up to 24% off on an annual plan)

You get everything in the Free account and:

- One metal card

- Ten free international payments per month

- 100 free local payments per month

- Foreign exchange up to £10,000 per month with a 0.4% markup for each exchange after that

- A crypto exchange fee of 0.99%

- Bulk payments, for example, when running payroll.

- Access to analytics

- Rewards – for example, a six-month free Shopify trial and 20% off your first purchase on Fiverr

- Business API integrations

- Forward currency contracts

Scale

This costs a monthly fee of £100 (up to 21% off with annual billing).

You get everything above, and:

- Two metal cards

- 50 free international payments per month

- 1,000 free local payments per month

- Foreign exchange up to £50,000 per month with a 0.4% markup after that

Enterprise – Custom Pricing

All the above features are customized to your needs, and you benefit from a dedicated account manager.

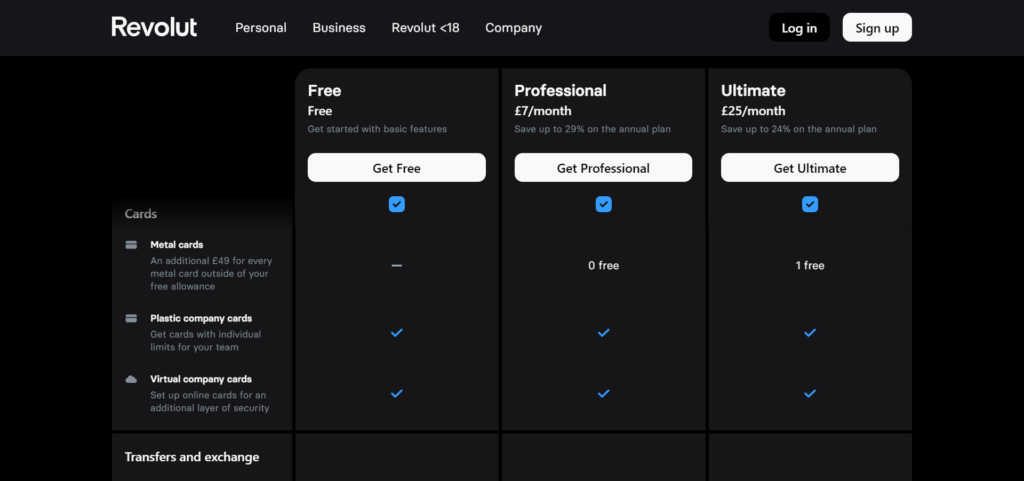

For Freelancers, there are three accounts:

Free

For this, you get:

- Plastic company cards

- Virtual cards

- Five free local payments a month (£0.20 per payment after that)

- A £3 fee per international payment (weekend and rare currency markups apply)

- Spend like a local in 150+ countries and 150+ currencies

- Hold and exchange 25+ currencies

- Free transfers to Revolut accounts

- IBANs for global transfers

- You can manage recurring transfers

- Local accounts in GBP and EUR

- Accept payments online and in person with fees the same as those quoted above

- Create and track invoices

- Accept payments on your website

- Create and share payment links

- Invite unlimited team members and assign them permissions

- Access to 24/7 support

- Manage payroll (£3 per month per team member on the payroll)

Professional

This costs £7 per month (or up to 29% off if you pay annually)

For this, you get everything in the free freelancer plan and:

- Five free international payments per month (the fees mentioned above apply after that)

- 20 free local payments per month (the fees mentioned above apply after that)

- Foreign exchange to a £5,000 limit per month with a 0.4% markup for each exchange after that

- The ability to make bulk payments

Ultimate

This costs £25 a month (or up to 24% off if you pay annually).

For this, you get everything in the Free and Professional plans, and:

- One metal card

- Ten free international payments per month (with the fees mentioned above applied after that

- 100 free local payments per month (with the fees discussed above applied after that)

- Foreign exchange to a £10,000 limit per month with a 0.4% markup on each exchange after that

Monzo Business Prices

Monzo Business has two accounts:

Business Lite

With this free account, Monzo offers:

- Access to a complete UK business current account

- Mobile sign-up

- Access to an account-switching service

- Apple Pay and Google Pay are supported

- Fee-free spending abroad

- You can manage your scheduled payments

- Cash cheques at a PayPoint for £1 (deposit £5-£300 in one go, with a threshold of £1,000 every 180 days).

- Up to £85,000 of your money is protected with the financial services compensation scheme (FSCS)

- Advanced security (payment approvals, card freezing, fingerprint, and face recognition, and PIN protection)

- Mobile and web access

- You can create payment links

- You can accept Stripe card payments.

- Send and receive UK bank transfers to your account for free (until 2024, but no further details are supplied about that)

- A business debit card

- 24/7 in-app human help

- Instant access savings pots

- Organize your money into pots to separate your finances

- Instant notifications when money goes in and out of your account

- Categorize your spending per month

- Add receipts to payments while you’re out and about

- International transfers to 70+ countries powered by Wise

- Inbound Euro payments (unspecified fees apply)

Business Pro

This costs £5 a month, and for this, you get everything in Business Lite and:

- Tax pots

- Integrated accounting (as described in the features section above)

- Multi-user access (as described in the features section above)

- Invoicing – create, send, and track invoices via the Monzo app or your internet browser

- Access exclusive offers such as six months free Xero

- Virtual cards

- You can auto-export transactions to a Google Sheet

Revolut Business vs Monzo Business: Pros and Cons

Revolut Business Pros and Cons

Revolut Business Pros 👍

- You can transfer and exchange money in 25+ currencies

- There’s a wide range of business accounts, including ones for solo operators

- 24/7 support is available for all plan holders

- QR code feature is handy for in-person sellers

- Revolut is fully FCA regulated

Revolut Business Cons 👎

- There’s no option to make cash deposits

- Revolut doesn’t offer overdraft facilities

- There’s a 2% fee for ATM transactions, irrespective of which plan you’re on, which seems pricey

Monzo Pros and Cons

Pros 👍

- 24/7 human in-app support is available

- Monzo is FCA regulated

- Monzo’s pricing is simple to understand and very reasonably priced paid

- You can benefit from fee-free spending abroad

- Monzo’s tax pot feature ensures you save enough for the taxman.

Cons 👎

- You can only deposit £300 in one go and up to £1,000 every 180 days

- It’s aimed at small businesses, so there are no accounts offered for larger-sized companies

- It doesn’t offer an overdraft facility on its business accounts, only its personal accounts

Revolut Business vs Monzo Business: My Final Verdict

Congrats! You’ve made it to the end of my Revolut Business vs Monzo Business review. Hopefully, you have a clearer idea of what each provides.

Overall I think Monzo Business is worth more than a second glance if you're a small business. You can head for its free account and upgrade to the low-cost Pro account whenever you’re ready.

In contrast, Revolut Business has been around longer and offers more accounts to choose from, so if you’re looking for a provider with whom you can grow, this may be your preference.

All in all, both have something positive to offer. Still, the most suitable choice for your business comes down to what you’re looking for, so do your homework before you decide!

That's enough from me; I want to hear your thoughts in the comments box below. Will you be going for Monzo, Revolut, or are you considering one of their competitors like Starling Bank? Either way, tell me all about it below!

Comments 0 Responses